The best portfolio for the next decade

Open Editor’s Digest for free

Rola Khalaf, editor of FTE, selects her favorite stories in this weekly newsletter.

The author is head of asset allocation research at Goldman Sachs

Since interest rates began to rise in 2022, investors have been recovering from a major shock to their portfolios — and to their belief system around multi-asset diversification.

Rising inflation during the recovery from the Covid-19 crisis has led to the biggest losses for multi-asset portfolios in more than a century. But until then, a simple buy-and-hold portfolio of 60 percent invested in equities, 40 percent in bonds was remarkably successful for the current generation of investors. Inflation has now largely normalized. So, what’s the best portfolio for the next decade – is it right to go back to 60/40?

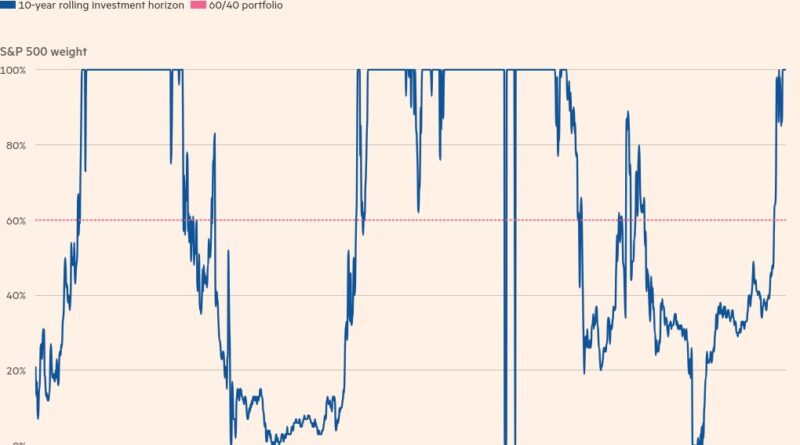

Modern portfolio theory developed by Nobel laureate Harry Markowitz allows us to create so-called “optimal portfolios” with a higher return than the risk, by incorporating the potential for diversification. This portfolio can then be combined with cash or cash based on risk tolerance. In hindsight, the 60/40 portfolio actually produced the highest risk-adjusted returns since 1900, but over 10-year rolling investment horizons the optimal asset mix had large swings and rarely stayed at 60/40. was located in

In fact, the top asset mix was more like 40/60 in the three decades leading up to the Covid-19 crisis. Aided by low and anchored inflation, the bonds had a strong bull market and provided diversification benefits through buffering equity during episodes when investors chose a “risk-off” approach. But since 2022, long-term bonds have performed poorly. While bond yields are now high and near long-term averages, price volatility remains high. The yield curve on bonds of varying degrees is also flat. These factors offer less leverage than cash alone.

As a result of weak bond performance since 2022 — but strong equity returns — the optimal portfolio has shifted to nearly 100 percent equities over the past decade. Ironically, the value of long-term bonds in portfolios remains in question. With more uncertainty about inflation in the coming years, as well as increased risk from fiscal policies and high government debt-to-GDP ratios, bonds have also become risky.

Still, having only equities in the portfolio seems ill-advised after a strong rally and high equity valuations, especially in the US. Estimated equity risk premia—that is, the potential excess return for equities versus bonds—are at the low end of their historical range. This could reflect long-term concerns about inflation or long-term growth optimism.

We think the latter is more likely, in part because of technology revolutions like artificial AI and new weight-loss drugs, but also because of the unusually high profitability of the US tech sector. In past periods of high yield growth, such as the 1920s and 1950/60s, equities also outperformed bonds over the long term.

However, potential negative trends for equity include: deglobalization, both economically and geopolitically; decarbonisation, with the risk of commodity supply shocks and increased costs around climate change; and demographic trends such as low population growth, high unemployment rates and income inequality.

So for the coming years we see value in becoming more balanced again in a multi-asset portfolio. Diversification of construction risks requires greater diversification. An ideal portfolio for the next decade might be one-third equities with a bias toward “growth” stocks, one-third bonds, and one-third real estate.

In this portfolio, growth stocks will provide more targeted exposure to improve productivity and diversify the risk of volatility. A key challenge is that equity predicts higher productivity growth before it is realized, resulting in increased value expansion and the risk of overpayments. With growth stock valuations already elevated, investors will need to be smarter in their search for those who will benefit from future technology revolutions.

Bonds with high real yields will provide protection in the event of a recession. They currently factor in low inflation but if rate growth picks up, exposure to real assets in an optimized portfolio can help diversify risks. This includes stocks with pricing power in the infrastructure, real estate and commodity sectors. So investors can put an additional 20 percent of the portfolio into equities on top of investing in growth stocks. The rest of the real estate can go into inflation-linked bonds.

This trip brings us back to about a 60/40 portfolio. But the best portfolio for the next decade needs to address the potential for higher productivity growth and the risk of higher and more volatile inflation. This means more targeted exposure in equities and bonds.

#portfolio #decade